san antonio sales tax rate 2021

2020 rates included for use while preparing your income tax deduction. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

Texas Sales Tax Rates By City County 2022

For tax rates in other cities see Florida sales taxes by city and county.

. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. The minimum combined 2021 sales tax rate for san antonio texas is. There is no applicable county tax.

1000 City of San Antonio. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The Elmendorf sales tax rate is.

The san antonio sales tax rate is. The Official Tax Rate. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Thursday July 01 2021. 2021 Official Tax Rates. 6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax.

There is no applicable city tax or special tax. How Does Sales Tax in San Antonio compare to the rest of Texas. This rate includes any state county city and local sales taxes.

Box 839950 San Antonio TX 78283. See how we can help improve your knowledge of Math. The San Antonio Texas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in San Antonio Texas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within San Antonio Texas.

Local Sales Tax Rate For San Antonio Texas Maintenance operations mo and debt service. The december 2020 total local sales tax rate was also 7000. 0500 San Antonio MTA Metropolitan Transit Authority.

Monday-Friday 800 am - 445 pm. San Antonios current sales tax rate is 8250 and is distributed as follows. Scroll to see the property features tax value mortgage calculator nearby schools and similar homes for sale.

Texas state rates for 2021. 0125 dedicated to the City of San Antonio Ready to Work Program. 4 rows The current total local sales tax rate in San Antonio TX is 8250.

The county sales tax rate is. The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in Bexar County and specifically San Antonio when combined with the base rate of sales and use tax in Texas is 825. See how we can help improve your knowledge of math physics tax engineering and more.

The Texas sales tax rate is currently. 2021 Official Tax Rates. One of a suite of free online calculators provided by the team at iCalculator.

Build the online store that youve always dreamed of. The minimum combined 2021 sales tax rate for san antonio texas is. The rate of revenue growth projected in fy 2022 over the fy 2021 adopted budget is a 32 increase.

The December 2020. 05 lower than the maximum sales tax in FL. 0250 San Antonio ATD Advanced Transportation District.

The texas sales tax rate is currently. San Antonio collects the maximum legal local sales tax. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. 6 for the first month. 0 Vista West Dr currently not for sale is located in Chestnut Spgs Sub Ut-3 subdivision in Bexar County.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. The total sales tax rate in any given location can be broken down into state county city and special district rates. The property information herein and below is from the county appraisal district and should be independently verified.

Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value. You can print a 7 sales tax table here. It was lowered 15 from 825 to 675 in february 2021.

The minimum combined 2021 sales tax rate for Elmendorf Texas is. Road and Flood Control Fund. San Antonio TX 78207.

China grove which has a combined total rate of 172 percent has the lowest property tax rate in the san antonio area and poteet with. Sales and Use Tax. San antonio in texas has a tax rate of 825 for 2021 this includes the texas sales tax rate of 625 and local sales tax rates in san antonio totaling 2.

The minimum combined 2021 sales tax rate for san antonio florida is. The latest sales tax rate for San Antonio Heights CA. This is the total of state county and city sales tax rates.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. The County sales tax rate is.

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Guide And Calculator 2022 Taxjar

For Countless American Households Especially Those In More Expensive Markets Higher Loan Limits Open More Opportuni Loan Home Ownership Real Estate Investing

Understanding California S Sales Tax

Understanding California S Sales Tax

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Understanding California S Sales Tax

Texas Sales Tax Guide For Businesses

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Understanding California S Sales Tax

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

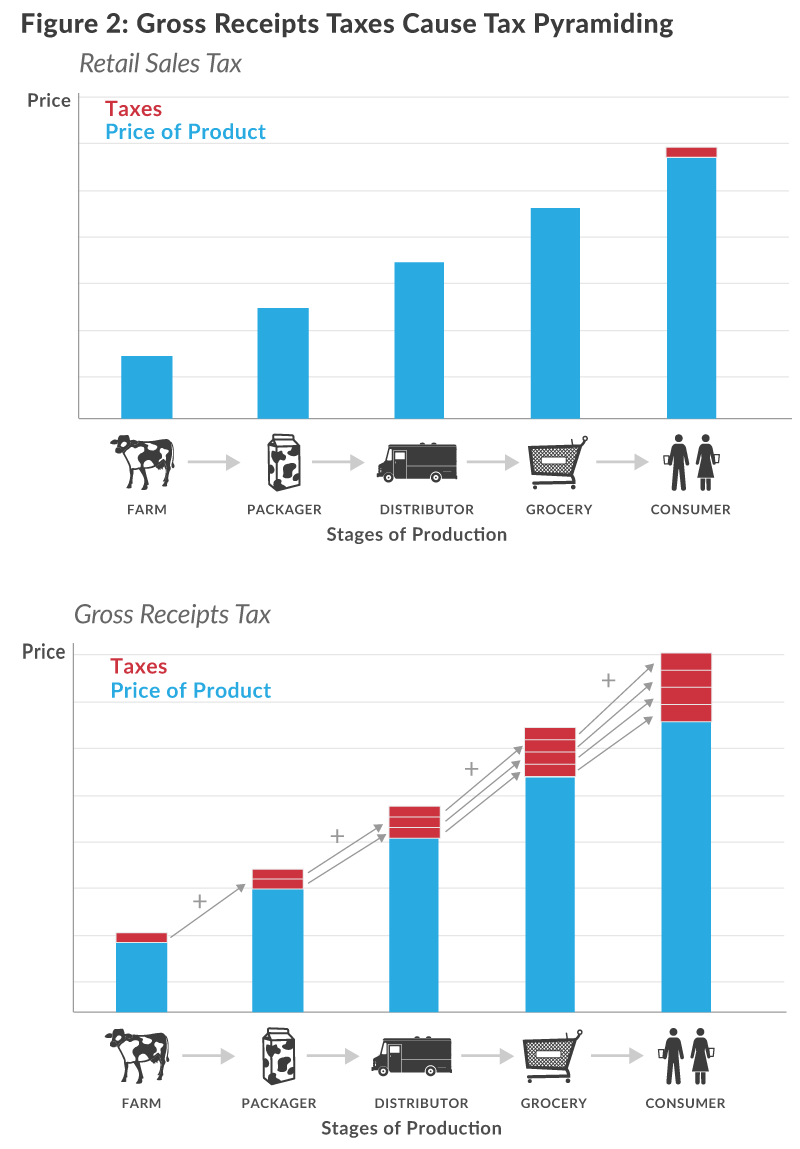

The Texas Margin Tax A Failed Experiment Tax Foundation

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Understanding California S Sales Tax

2021 Real Estate Market Real Estate Infographic Real Estate Marketing Marketing

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Which Texas Mega City Has Adopted The Highest Property Tax Rate