idaho sales tax rate in 2015

While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected. If you need access to a database of all Idaho local sales tax rates visit the sales tax data page.

How Much Is Your Rebate New Idaho Law Will Give 600 Million In Income Tax Cuts East Idaho News

Sales Tax Rate s c l sr.

. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Breakdown of taxes in Idaho excl. Please select a specific location in Idaho from the list below for specific Idaho Sales Tax Rates for each location in 2022 or calculate the Sales Tax.

Federal taxes Tax Type 2020 billion Change Share. You must complete Form CG to compute your Idaho capital gains deduction. 6 is the lowest possible tax rate Pocatello Idaho7 8 85 is all other possible sales tax rates of Idaho cities9 is the highest possible tax rate Sun Valley Idaho Fortunately the sales tax rate in Idaho.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Wayfair Inc affect Idaho. There is no applicable county tax city tax or special tax.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two columns. 83651 83653 83686 and 83687. SALES AND GROSS RECEIPTS TAXES.

It is 5139 of the total taxes 53 billion raised in Idaho. This includes hotel alcohol and sales taxes. You can find more tax rates and allowances for Nampa and Idaho in the 2022 Idaho Tax Tables.

Nampa in Idaho has a tax rate of 6 for 2022 this includes the Idaho Sales Tax Rate of 6 and Local Sales Tax Rates in Nampa totaling 0. Did South Dakota v. Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies.

31 rows The state sales tax rate in Idaho is 6000. The table also notes the states policy with respect to types of items commonly exempted from sales tax ie food prescription drugs and nonprescription drugs. So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality.

It explains sales and use tax requirements for those who buy or receive a. This guide is for individuals leasing companies nonprofit organizations or any other type of business that isnt a motor vehicle dealer registered in Idaho. The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government divisionYou can print a 6 sales tax table hereFor tax rates in other cities see Idaho sales taxes by city and county.

With local taxes the total. 2022 Idaho Sales Tax Table. Sales and Gross Receipts Taxes in Idaho amounts to 27 billion.

The sales tax jurisdiction name is Cassia which may refer to a local government division. The sales tax rate in Idaho for tax year 2015 was 6 percent. Has impacted many state nexus laws and sales tax collection requirements.

The state sales tax rate in Idaho is 6 but you can. The table below summarizes sales tax rates for Idaho and neighboring states in 2015. The 6 sales tax rate in Burley consists of 6 Idaho state sales tax.

Click here for a larger sales tax map or here for a sales tax table. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales.

An alternative sales tax rate of 6 applies in the tax region Canyon which appertains to zip codes 83651 83652 and 83653. Idahos capital gains deduction. 3 lower than the maximum sales tax in ID.

Numbers represent only state taxes not federal taxes. Idaho has 12 cities counties and special districts that collect a local sales tax in addition to the Idaho state sales taxClick any locality for a full breakdown of local property taxes or visit our Idaho sales tax calculator to lookup local rates by zip code. Idaho enacted its sales and use tax in 1965 and it was approved by the electorate during the 1966 election.

The Caldwell Sales Tax is collected by the merchant on all qualifying sales made within Caldwell. The Caldwell Idaho sales tax is 600 the same as the Idaho state sales tax. You can view your local Idaho sales tax rates using TaxJars sales tax calculator.

An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83686 and 83687. The 6 sales tax rate in Boise consists of 6 Idaho state sales taxThere is no applicable county tax city tax or special tax. Combined with the state sales tax the highest sales tax rate in Idaho is 9 in the city of Sun.

Prescription Drugs are exempt from the Idaho sales tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Idaho local counties cities and special taxation districts. 278 rows Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3There are a total of 112 local tax jurisdictions across the state collecting an average local tax of 0074.

5283 847. The Idaho Falls sales tax rate is. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006. The 2018 United States Supreme Court decision in South Dakota v. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

The Nampa Idaho sales tax rate of 6 applies to the following four zip codes.

Historical Idaho Tax Policy Information Ballotpedia

Pdf Sales Taxes And The Decision To Purchase Online

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

Sales Tax By State Is Saas Taxable Taxjar

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How To Charge Your Customers The Correct Sales Tax Rates

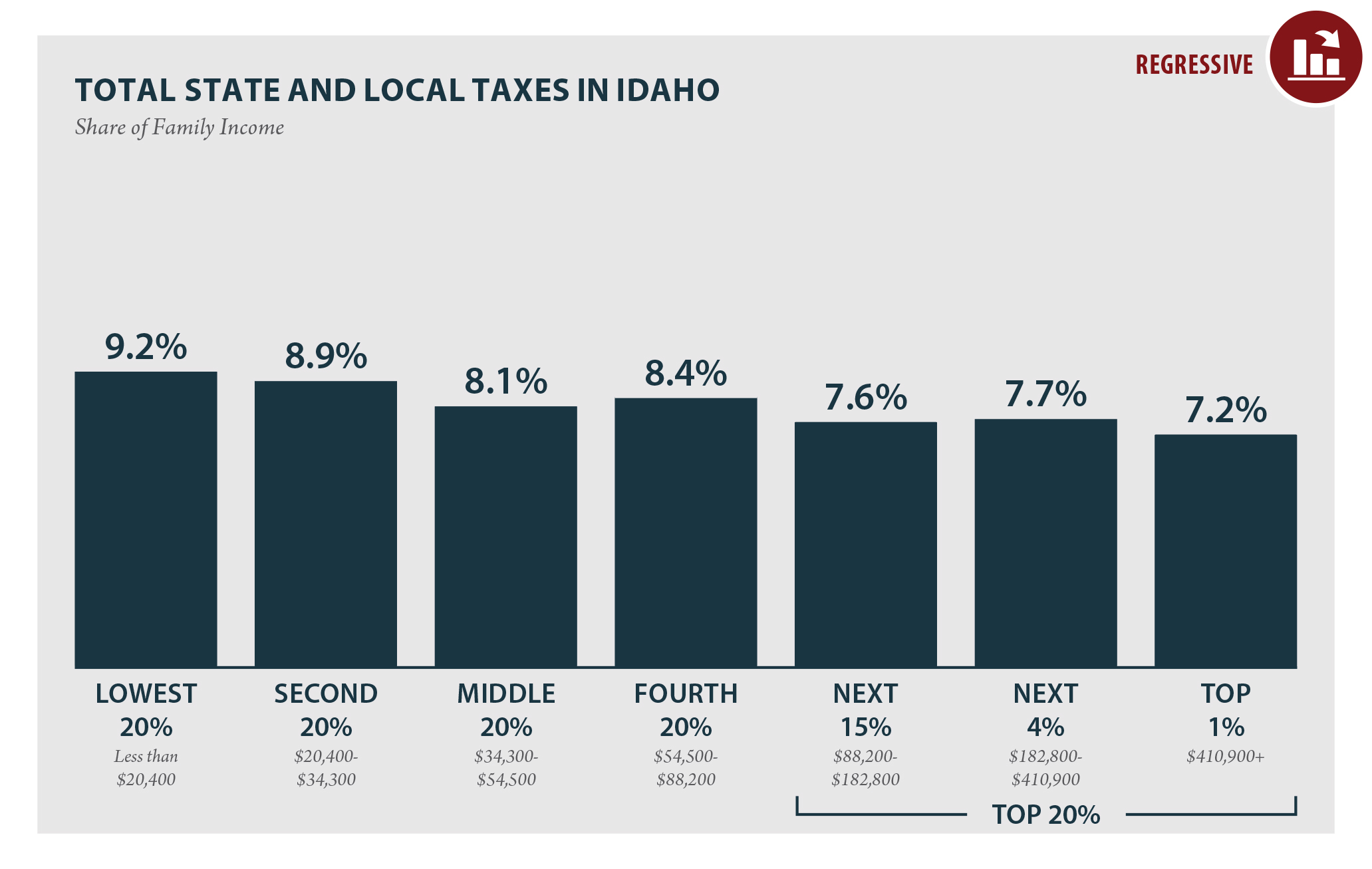

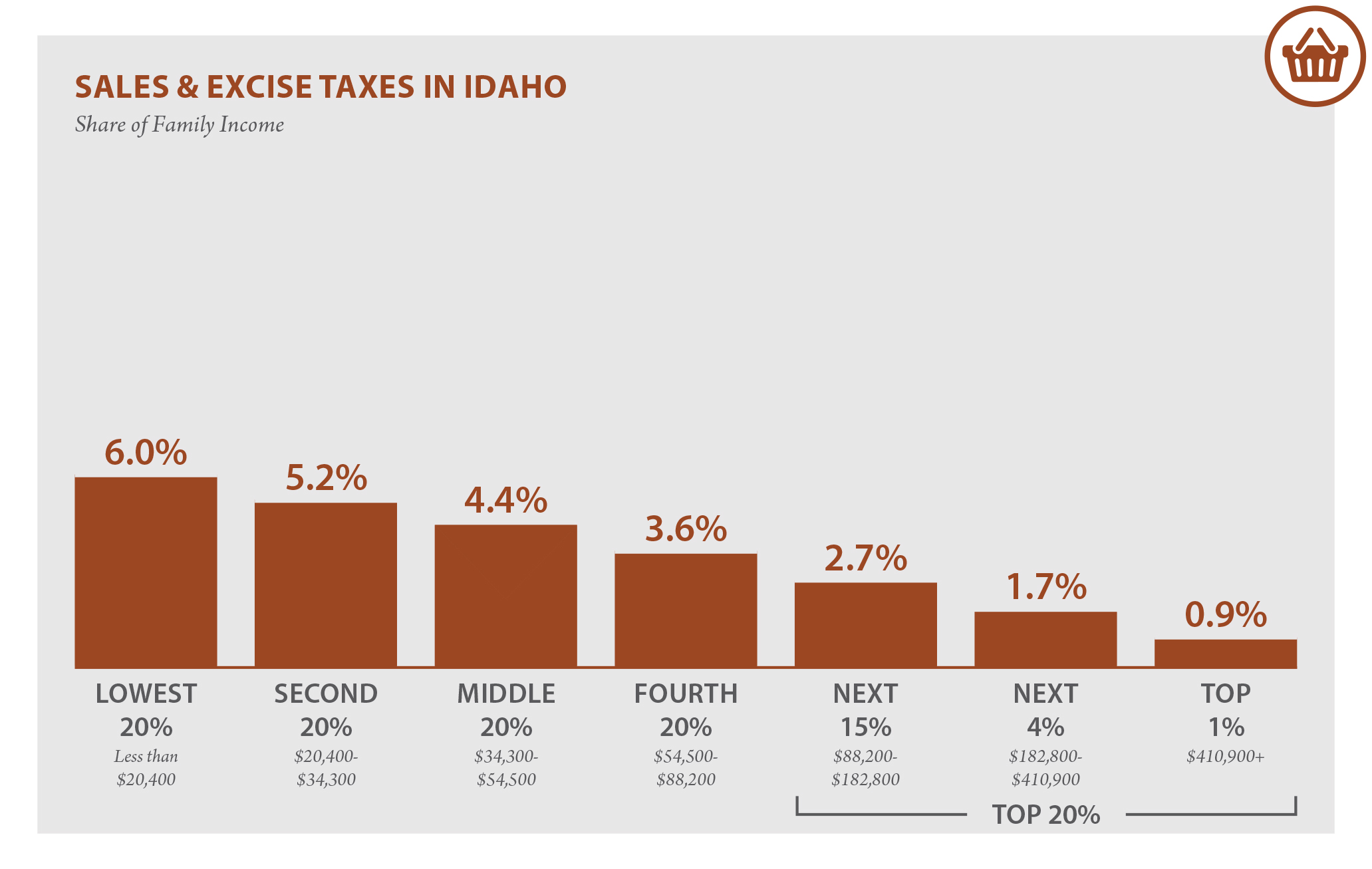

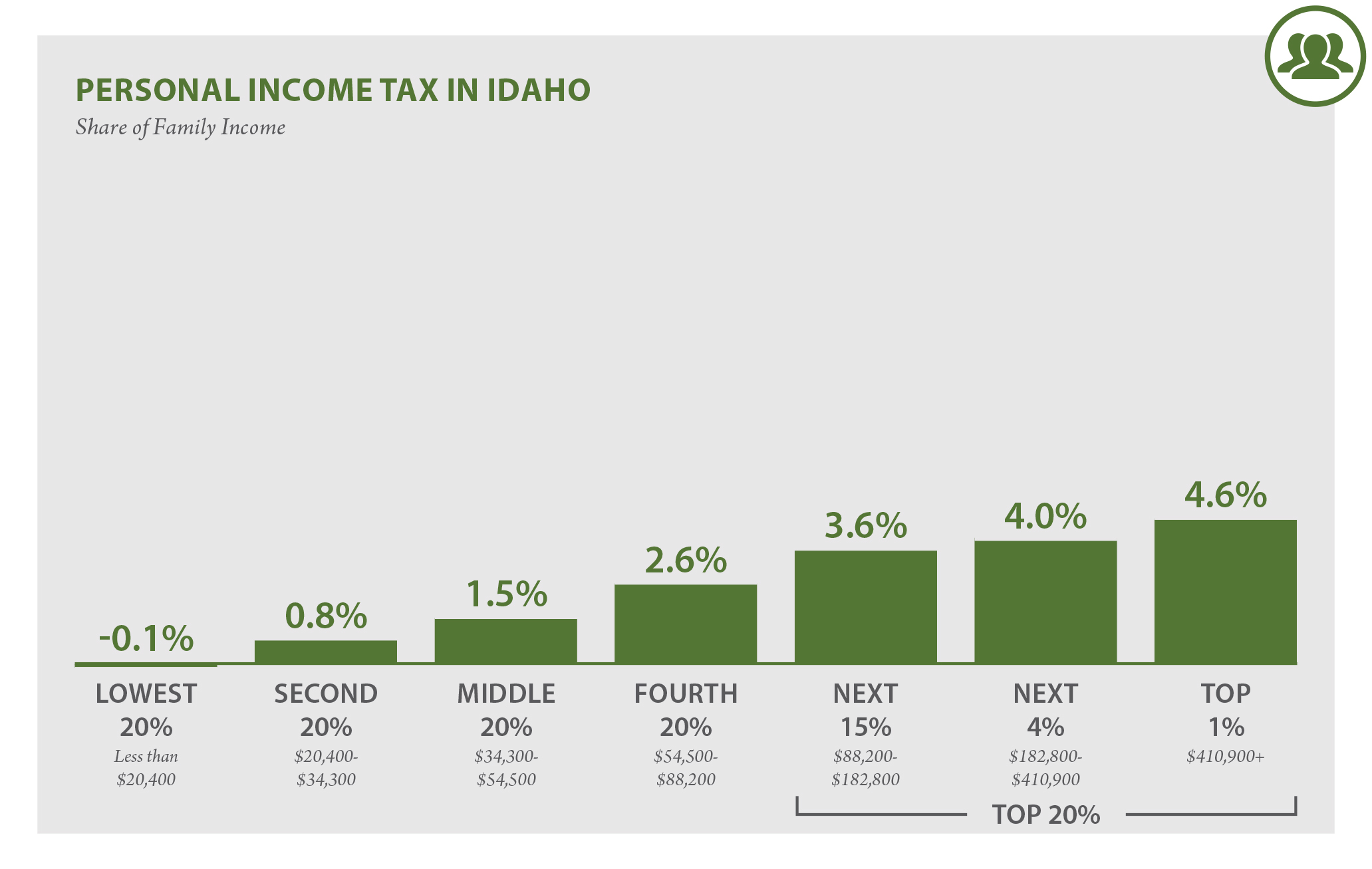

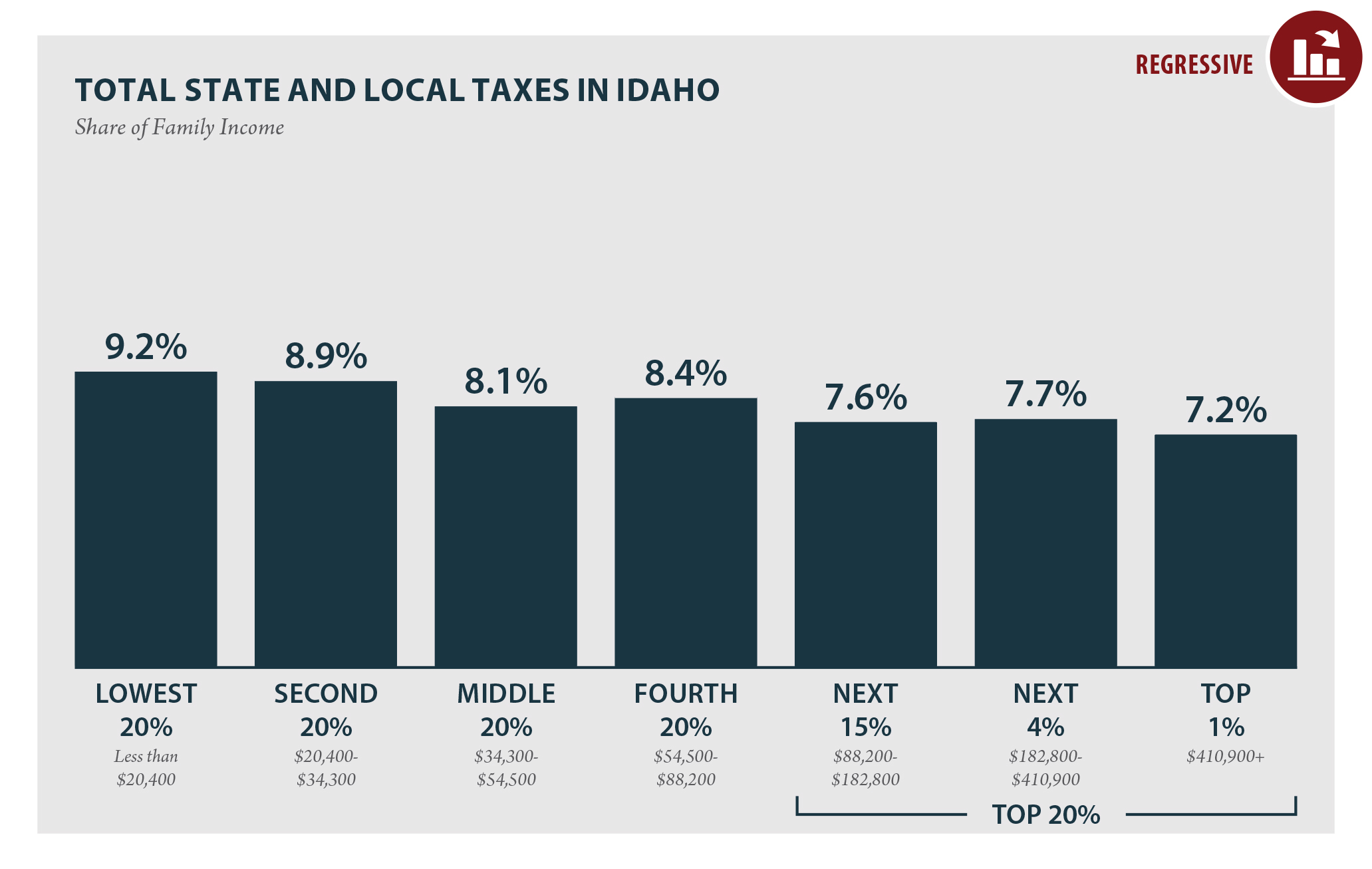

Idaho Who Pays 6th Edition Itep

Taxes Idaho Vs Washington Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur D Alene And The Inland Northwest

Idaho Property Taxes Everything You Need To Know

Idaho Who Pays 6th Edition Itep

Combined State And Local General Sales Tax Rates Download Table

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Idaho Who Pays 6th Edition Itep

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio